OPINION: The US Corn Crop’s Race to Finish

The recent bear trend in corn seems to make sense, as traders await an official estimate on planted area for this year on August 12, as well as an indication on yield.

Non-threatening weather, cheaper South American corn, soft ethanol demand, and cheap hard red wheat are all short-term bearish forces.

The actual weather in August, the results of the USDA reports, and China’s production prospects are factors which could spark a turn higher and test the June highs.

The market has also been pressured by the ongoing US and China trade spat, with recent negotiations ending without much fanfare. Talks are scheduled to continue in Washington in September, and news of this left the bulls with a “throw-in-the-towel” mentality in late July.

With the continued surge in the US dollar, a widening spread between South American and US corn offers for export, and a strong basis in the southeastern US, a 24,000 mt cargo of corn from Paraguay is headed for North Carolina for August 24th delivery.

The market remains vulnerable to increased selling as board support is violated.

Recent Commitments of Traders reports have shown large and small speculators holding a record net long position in corn futures. But while the short-term news flow is very bearish, there are plenty of long-term concerns.

US Crop Behind Normal

The US corn crop was planted late and as a result, progress is running behind normal.

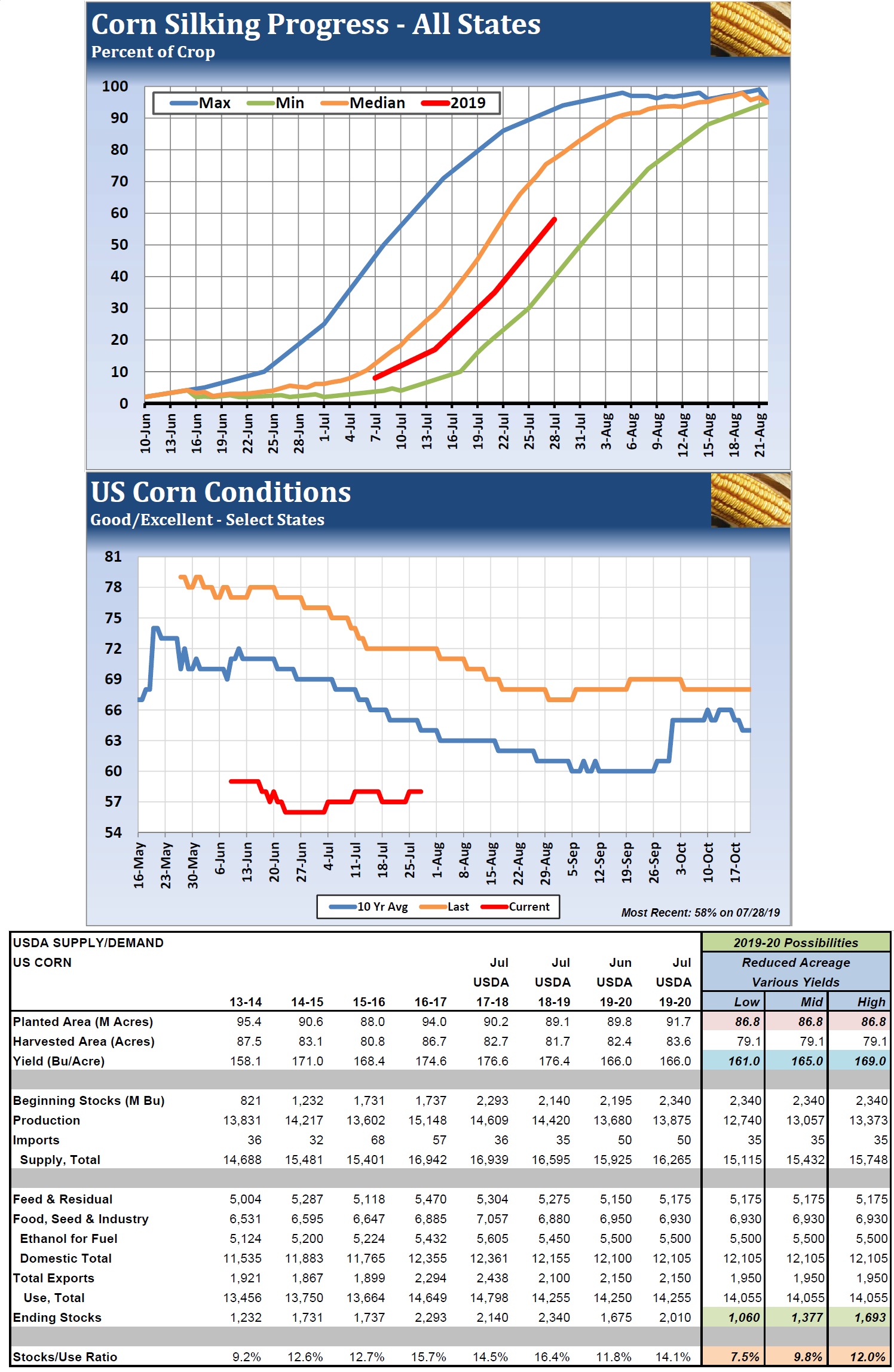

As of July 28, 58% of the US crop had reached the silking stage versus a 5-year average of 83%.

If we assume the crop will reach maturity 62 days after silking, that means that 42% of the crop will not mature by September 28th.

This could cause some problems as we move into October if there is an early freeze.

Some key states are well behind normal. Using the state-by-state data, the percent of state crops not mature by the end of September include North Dakota at 62%, South Dakota 73%, Wisconsin 72%, Illinois 41%, Indiana 60%, Michigan 80% and Ohio 68%. For a graph click here

The recent Crop Progress report showed declining conditions for the week ending July 28 in major producing states such as Indiana, South Dakota and Ohio. In Indiana, 36% of the crop was rated good/excellent (G/E), down from 69% last year. South Dakota was rated 61% G/E, down from 75% last year. Ohio was rated 34% G/E, down from 72% last year. For a graph click here

Outlook for August 12 USDA Reports

The USDA will release an official “resurvey” of its planted acreage on August 12. They are taking this unusual step on concerns that the June report did not reflect any reductions in planted acreage resulting from heavy rains and cool weather.

For the resurvey, traders are looking for losses of 5 to 8 million acres from the Prospective Plantings report in March that called for 92.8 million acres.

If yields slide at all from the USDA’s current estimate of 166 bushels/acre estimate, an extremely tight stocks situation may develop into 2020.

The USDA has so far held their yield assessments steady since June, but even with the recent good growing weather, their current estimate looks a bit too high given how poor crop conditions are running and how late the crop was planted.

In the supply/demand table below, we assumed a planted area of 86.8 million acres and a drop of 200 million bushels in the export forecast.

If we assume a 165 yield, ending stocks would slide to 1.377 billion bushels from the 2.010 billion-bushel estimate in the July USDA report, and from 2.340 billion last year. The 9.8% stocks/usage ratio that would result would be a six-year low. In the last 46 years, stocks/usage has been below 10% just six times.

If we assume a 161 yield, ending stocks would slide to 1.060 billion bushels and result in a stocks/usage ratio of 7.5%. This would be the third-lowest in at least 59 years, which is as far back as our records go. For a table click here

Potential Crop Problems in China and Europe

China imported 720,000 tonnes of corn in June, pushing their imports for the first half of the year to 3.1 million tonnes, up 40.9% from last year's pace. An armyworm infestation could be causing problems for China’s crop. Very high temperatures in Europe are also a production concern.